High natural gas prices will burden the European economy for years to come. This poses a particular problem for energy-intensive industrial production. The outlook for production, demand and employment in energy-intensive industries looks bleak, with governments spending enormous sums to keep companies afloat. The EU is mainly banking on a pivot to renewable hydrogen to address the problem in the medium term. The “green gas” is expected to help deliver on climate objectives and – so the idea goes - simultaneously safeguard energy-intensive production by freeing EU industry from high fossil fuel prices in the future.

However, while hydrogen-based, emission-neutral production will indeed be necessary for reaching climate targets, it is much less clear whether it can also salvage EU competitiveness. Firstly, the EU lacks renewable energy potential. Compared to other sunnier and windier regions in the world, it will always be relatively expensive to produce large amounts of green hydrogen in Europe. Secondly, the physical properties of hydrogen make it very expensive to ship over long distances. Sourcing hydrogen from faraway places – as Europe has done with oil and gas – will therefore come with a large price tag.

The latter point in particular has often been overlooked in the debate so far. As our new interactive model shows, the high transport costs of imported hydrogen will become a major problem for the EU’s competitiveness in energy-intensive sectors. To deal with his reality, the EU’s hydrogen strategy needs to prioritise three areas:

To reach climate targets, goods used and produced in the EU will eventually have to become emission-neutral. A global market for green products will develop, on which European producers will have to openly compete.2 However, in the absence of government support and protection, hydrogen-intensive industries in the EU face a large cost disadvantage for two reasons:

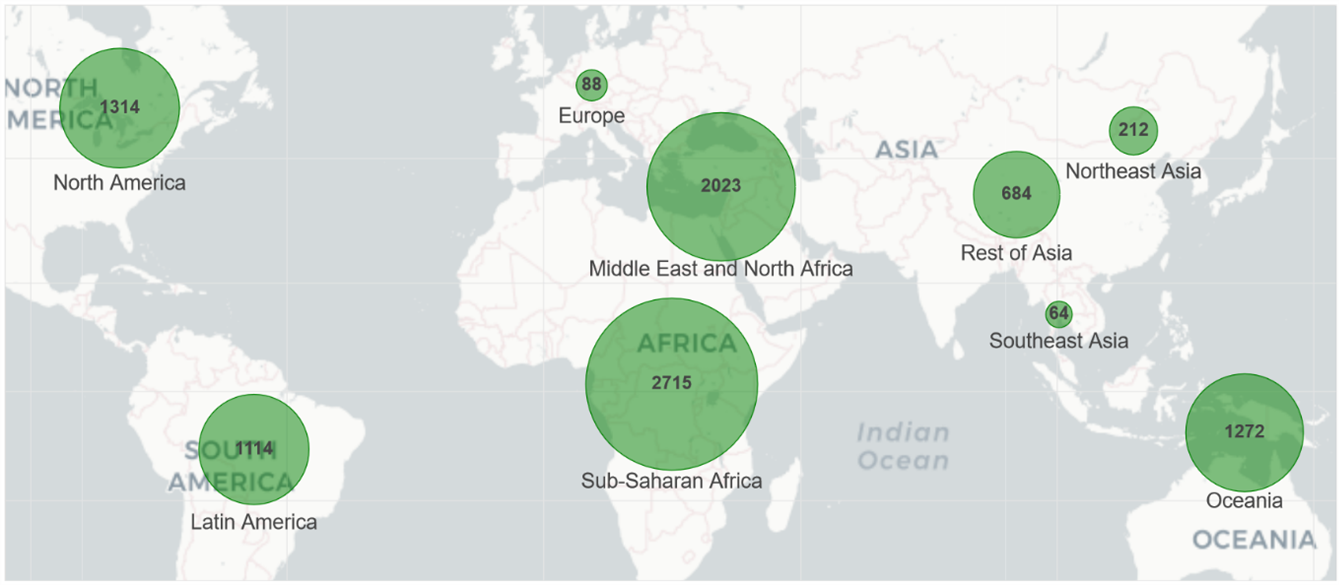

First, the EU has significantly worse renewable energy potential than many other regions. Producing renewable hydrogen requires large amounts of clean electricity,3 meaning that countries with high solar and wind potentials, such as Chile or Australia, can generate renewable hydrogen much more cheaply than the EU. Figure 1 shows that North America, for instance, could produce 15 times more renewable hydrogen (defined as under 1.5 USD/kg) than Europe, given their favourable geographical conditions. Most EU member states will not be able to produce enough renewable hydrogen themselves, or only at prohibitively high costs.4 Hence, the EU would need to import substantial volumes of hydrogen in order to keep the current level of industrial output and satisfy the demand for other hydrogen uses (e.g. in the power sector). This is reflected for instance in the Commission’s REPowerEU planning, which aims to import half of the hydrogen needed in 2030, and by the intensifying focus on hydrogen partnerships with third countries.

Figure 1: Annual production potential for cheap renewable hydrogen (under 1.5 USD/kg)

Source: IRENA 2022. Units are Exajoule. Map: OpenStreetMap, CartoDB

Source: IRENA 2022. Units are Exajoule. Map: OpenStreetMap, CartoDB

Second, transport costs of hydrogen are high and will stay high – certainly much higher than transport costs for oil, natural gas or coal. This fact seems to be underappreciated in the debate. But it will most likely have severe implications for the EU’s industrial competitiveness in some sectors.

There are three main options for hydrogen transport over long distances: pipelines, liquid hydrogen shipping, and shipping a hydrogen-carrier substance, like ammonia. Pipelines are the cheapest option over short and medium distances. But it should be noted that the existing gas pipelines are either not suitable at all or need expensive upgrading (“repurposing”) for hydrogen use. Hence, pipelines also have a substantial price tag. For long-range transport, e.g. from other continents, shipping liquified hydrogen is a possibility. This is expensive because it wastes a lot of energy to liquify hydrogen and keep it at -253°C, which requires highly specialised ships (for comparison, LNG only requires a temperature of -160°C). Liquid hydrogen ships so far do not exist at scale, making cost estimations difficult. An alternative shipping method is to convert hydrogen into a different material that is easier to ship, such as ammonia. Ammonia ships do exist at scale, and compared to liquid hydrogen, the vessels are comparatively simple and hence cheap. However, converting hydrogen into a material like ammonia, shipping it, and then reconverting it back to hydrogen upon arrival in Europe requires high amounts of energy, and is hence also very costly.

The interactive chart below illustrates just how expensive transporting hydrogen of long-distances is. It focuses on the production of steel as one of the main energy-intensive industries in the EU. To show the impact on competitiveness, it depicts transport costs as a percentage of the total production cost of a tonne of steel, under different assumptions for different routes.

On the map on the left, three illustrative hydrogen import routes are shown (ammonia via ship from Canada, gaseous hydrogen via pipeline from Saudi Arabia, and liquid hydrogen via ship from South Africa).

On the right, cost parameters can be set, with estimates from the literature as reference in the dropdown-menus next to them. The bar chart on the right shows the resulting cost depending on the cost parameters for each route, expressed as a percentage of the production cost of a tonne of steel. By clicking on the tab “distance costs” on top of the bar chart, the costs per kilometre for each of the three transport methods can be shown (independent of the routes), revealing which technology is cheapest at a given distance. Note that in the production cost (the denominator for the charts) the cost of hydrogen transport is excluded for simplicity.

A custom route can be created by clicking multiple times on the map: the first click is the route’s start point, the last click its end point. Via the three buttons below the map (Pipeline, Liquified hydrogen, Ammonia), a transport technology can be selected for each leg of the custom route. By selecting one of the three map tools, the map can be moved, as well as zoomed in and out.

To pick an illustrative example for transport costs: Germany recently agreed on a hydrogen partnership with Canada. As shown in Figure 2, if Canadian hydrogen is converted to ammonia, shipped to France, reconverted back to hydrogen, and delivered from France to Germany via pipeline, the transport costs could amount to about €2.50 per kg of hydrogen, which equals about 25% of the production costs of a tonne of green steel. In other words, producing steel directly in Canada instead of first importing Canadian hydrogen to Germany is 25% cheaper, all else being equal.

Pipelines will likely be the cheapest option for imports from neighbouring regions, such as North Africa, or even the Arabian Peninsula. Yet, the transport costs will still be substantial. Constructing a pipeline from Saudi Arabia to Poland, for instance, would generate costs of more than 10% of a tonne of steel. For an (underwater) pipeline from North Africa, delivering hydrogen to France via Spain, costs would also amount to about 10% of a tonne of steel. These figures vary significantly depending on the assumed cost parameters. The main result, however, remains the same: importing hydrogen will become a major cost driver for EU industry.

Importantly, the cost is unlikely to decline much over time. As technology progresses and markets scale up, a small cost reduction will certainly occur - but comparisons with e.g. the plummeting cost of solar panels seem overly optimistic, given hydrogen’s physical properties and the limited cost reduction potential for building pipelines and ships.

Hydrogen transport costs for an energy-intensive product, say green steel, would also be much more expensive than transporting the final good itself. Hence, hydrogen transport costs are not just a problem for export-oriented producers located in the EU. They are also a problem for European manufacturers selling to local customers.

Total production costs depend on a variety of factors, of course, not just transport cost. And institutions, human capital and cluster effects can outweigh some cost disadvantages. But cost savings of this magnitude would exert substantial pressure to re-locate some hydrogen-reliant industry to parts of the world that have higher hydrogen potential. This is especially true for companies that are very energy-intensive and would need large amounts of renewable hydrogen.

The EU Commission announced in REPowerEU that it would develop a hydrogen infrastructure mapping by March 2023. The preliminary analyses in REPowerEU already contained “hydrogen import corridors”, which entail hydrogen imports from the EU’s neighbouring regions. This focus on EU neighbours is good, since it keeps costs low. But at the same time, the EU Commission and national governments are aggressively pursuing hydrogen partnerships with far-away countries, revealing that there is an insufficient awareness of just how high transport costs will be.

In its upcoming infrastructure mapping, it is therefore crucial that the Commission accounts for hydrogen’s high transport costs and the heterogeneously distributed renewable potential. This can be done chiefly through two channels: by lowering the cost of hydrogen transport within EU territory, and by pursuing an import strategy that emphasises cost reduction.

Making hydrogen transport within the EU as cheap as possible

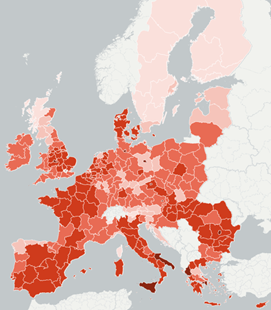

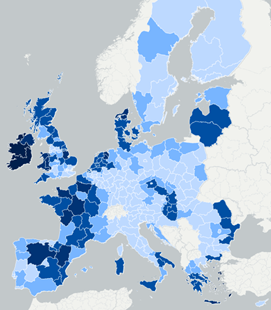

Transport costs within Europe will be a substantial part of the overall cost of hydrogen. This is due to the fact that hydrogen supply will oftentimes be far from the demand sites.5 This is clearly the case for imported hydrogen, since it arrives at the EU borders. It is also the case for EU-produced hydrogen, since the renewable energy potential in Europe is heterogeneously distributed, and often not particularly high at forecasted hydrogen demand sites. Figure 3 maps solar and onshore wind6 potential within the EU, revealing the large differences between regions. Hence, there will also be significant transport of hydrogen within EU territory.

To reduce intra-EU hydrogen transport costs, energy connectedness should be improved in two ways. First, by building an expansive hydrogen pipeline network, supported by public funds. This will be costly initially but reduce costs in the long run, because it lowers the need for expensive hydrogen shipping.7 Pipelines will also reduce cost for hydrogen distribution (i.e. getting hydrogen the last 50-100 kilometres to the production site), which would likely have to be done via expensive trucking, absent a pipeline. A hydrogen pipeline network will also allow taking full advantage of the renewable energy potential that the EU does have, since particularly sunny and windy locations in the EU could more easily sell hydrogen to locations that demand it.

Figure 3: Renewable electricity potential within Europe

Solar production potential

Solar production potential

Onshore wind production potential

Onshore wind production potential

Second, an improved electricity interconnectedness in the EU will also reduce hydrogen costs by making EU-based hydrogen production cheaper. A reinforced electricity grid will allow for the transport of electricity from locations that are windy or sunny to dark, wind-still locations at a given point in time. This allows electrolysers, which use electricity to generate hydrogen, to be run at more hours, increasing their utilisation rate. Since electrolysers are capital-intensive, a higher utilisation rate will push the cost of hydrogen produced in the EU down.

Improving energy connectedness has clear EU-wide benefits, but costs for hydrogen pipelines and electricity grids are typically borne privately or by individual member states. Especially for transit countries, costs might outweigh the benefits, and private network companies might be deterred from investing in hydrogen infrastructure given that the hydrogen market is still nascent. This is the reason why EU funding can and should be provided, for instance via the Connecting Europe Facility (CEF). However, the CEF has a budget of less than €6 billion for 2021-2027 for energy projects, whereas the investment needs are much larger. Not even considering public investment required for electricity grid reinforcement, the investment needs for hydrogen pipelines (made up of a yet to be determined mix of private and public investments) are estimated by the “Hydrogen Backbone” project to be around €80-140 billion by 2040.8 Hence, more EU financing should be allocated to the CEF, or to a new dedicated hydrogen infrastructure facility.

The planned “BarMar” underwater pipeline, connecting Barcelona with Marseille, might serve as a first high-profile hydrogen infrastructure project. The months-long tussle between the French, Portuguese, German and Spanish heads of government that preceded the BarMar agreement revealed how difficult cross-country infrastructure planning and financing can be, and that member state interests are not always aligned. France already indicated the intention to use European funding, revealing that there is not yet sufficient willingness from the private sector to finance hydrogen infrastructure projects, and the increasing role that CEF has to play. Despite BarMar’s high prominence and priority, the pipeline is not expected to be ready before 2030, showing the need to start similar projects quickly.

Importing hydrogen from third countries via short pipelines

To reduce the transport cost of hydrogen imported to the EU, the EU Commission should develop an import strategy that heavily factors in expected transport costs. So far, it remains unclear whether the Commission is on track to do this. For instance, the Commission has not released information on where the 10 million tonnes of imported hydrogen in 2030 should come from. At COP27, the Commission started signing hydrogen partnerships, and the selection of partner countries – including distant countries like Namibia – does not indicate that low transport costs factor sufficiently in the nascent strategy.

Reducing transport costs of imported hydrogen implies two things: First, imports should rely mostly on the cheapest technologies. For the most part, this means to prioritise pipelines, given the high costs of converting hydrogen to other substances like ammonia and reconverting them back, and the high costs of shipping liquid hydrogen. Second, given that pipelines are the most cost-efficient technology, import routes should be short, i.e. from neighbouring regions like North Africa, given that pipeline costs increase linearly with distance.

While shipping hydrogen from far-away locations will not be cost optimal, it can be used as a complement, with the aim to improve the resilience of hydrogen imports. By diversifying import partners and installing spare liquid hydrogen capacity, the mistakes made with Russia – being dependent on a single, unreliable energy supplier – can be avoided.

With the steps described above, the transport costs and hence final cost of hydrogen used in the EU can be somewhat reduced. This is crucial to enable the hydrogen economy in the EU generally. But these cost reductions have clear limits. Hydrogen’s physical properties will always make transporting it over long distances highly expensive. For companies based in the EU that need a lot of hydrogen per Euro of value added, it will hence be difficult to remain internationally competitive.

Coping with this reality has direct repercussions for the EU’s current energy policies. Against the backdrop of high energy prices, many governments are now heavily supporting energy-intensive companies to keep them from bankruptcy. In many national schemes, companies get support in exchange for pivoting their production towards CO2-neutral methods, such as direct electrification and (where direct electrification is not possible) to renewable hydrogen. This seems indeed like a sensible approach for industries that can directly electrify. It can also be the best course of action for industries with strategic or geopolitical relevance. But for other industries, especially if they will have to use large volumes of hydrogen relative to the value they add, it is not. For these companies, taxpayer support would be required indefinitely, with limited societal benefits.

Some industries will simply not be competitive in Europe anymore – not with natural gas today, nor with hydrogen in the future. It would hence be better to curtail public financial support in the current energy crisis for those industries, instead of artificially keeping them alive at a high cost to taxpayers. Similarly, the EU Commission should restrict the temporary crisis state aid framework to ensure that only those industries that have a chance at being competitive again in the future can receive support. Furthermore, if a price cap for natural gas is implemented on EU level, it should be designed in a way that allows to distinguish between different (sub)types of industries, and only be applied to those that can realistically regain their competitiveness.

By moving boldly, the EU can do a lot to alleviate the EU’s locational disadvantage. But policy cannot do much to alter the renewable electricity potential nor the physical difficulty of transporting hydrogen, and consequently, for some industries in the EU, hydrogen won’t be the silver bullet.

Footnotes:

1 I would like to thank Antonia Fidler for research assistance.

2 The alternative to open international competition would be for the EU to continue subsidising hydrogen-based production indefinitely, and not just in a transition period. This seems fiscally untenable as a long-term solution, except for a limited set of industries that have geostrategic importance.

3 Nuclear electricity is sometimes proposed as a solution for abundant EU-based hydrogen production, but it might be too expensive relative to solar and wind, given the quickly falling costs of solar- and wind-produced electricity. Moreover, nuclear electricity is currently not foreseen under EU rules to be eligible for renewable hydrogen production, and many EU countries oppose the expansion of nuclear power.

4 A proposed alternative to renewable hydrogen (hydrogen produced with green electricity) would be “blue hydrogen”, i.e. producing hydrogen from fossil fuels with emission capturing. However, the EU strategy eschews blue hydrogen in the medium and long term since renewable hydrogen is expected to become cheaper than blue hydrogen, and carbon capturing in hydrogen production has technical limits, rendering it less conducive to the primary objective of decarbonisation.

5 It is likely that some energy-intensive industries will relocate within Europe to areas with higher renewable energy potential. But because of cluster effects and high initial investment costs for factories, many demand centres will not be close to high renewable potential, especially during the early phase of the hydrogen transition. On forecasted hydrogen demand and supply centres, also see a study by Agora Energiewende

6 Offshore wind potential is also unevenly distributed across the EU, but is not mapped here since uncertainties regarding the economic viability of floating offshore wind parks result in high variance of production potential estimations.

7 In this context, it should be noted that the LNG terminals that are now being built to substitute Russian gas would need very expensive repurposing to be suitable for hydrogen imports, despite being advertised as already being “hydrogen ready” (see Fraunhofer study).

8 The “Hydrogen Backbone” is a proposal by gas network companies for a comprehensive pipeline network. It estimates investment needs by 2040 to be around €80-140 billion, with annual operating costs of €1.6-3.2 billion. However, it should be noted that the assumptions made in the proposal often seem to be tilted towards the interest of the gas network companies.

Gefördert durch: